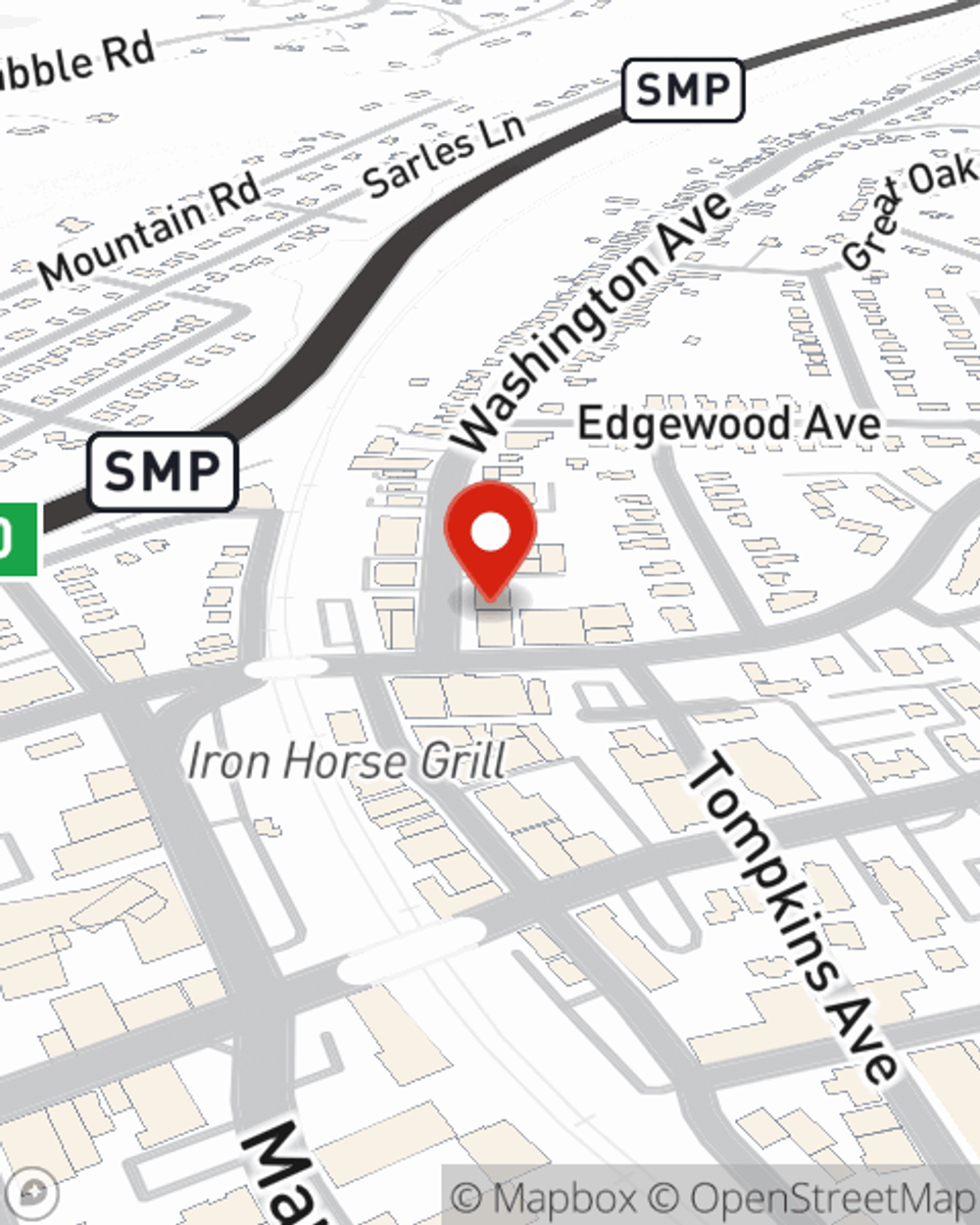

Business Insurance in and around Pleasantville

Looking for small business insurance coverage?

Helping insure businesses can be the neighborly thing to do

- New York

- New Jersey

- Connecticut

- Pennsylvania

- Valhalla, NY

- Tarrytown, NY

- Rye, NY

- Mount Kisco, NY

- Port Chester, NY

- Peekskill, NY

- Harrison, NY

- Chappaqua, NY

- Armonk, NY

- Katonah, NY

- Briarcliff Manor, NY

- Bedford, NY

- Yorktown Heights, NY

- Irvington, NY

- Hawthorne, NY

- Bedford Hills, NY

- Pound Ridge, NY

- Scarsdale, NY

- Dobbs Ferry, NY

- Elmsford, NY

Insure The Business You've Built.

When experiencing the wins and losses of small business ownership, let State Farm take one thing off your plate and help provide great insurance for your business. Your policy can include options such as business continuity plans, a surety or fidelity bond, and extra liability coverage.

Looking for small business insurance coverage?

Helping insure businesses can be the neighborly thing to do

Get Down To Business With State Farm

When you've put so much personal interest in a small business like yours, whether it's a pottery shop, a photography business, or a donut shop, having the right coverage for you is important. As a business owner, as well, State Farm agent Garret Byrne understands and is happy to offer exceptional service to fit your needs.

Get right down to business by reaching out to agent Garret Byrne's team to learn more about your options.

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.

Garret Byrne

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.